Eidl loan amortization schedule

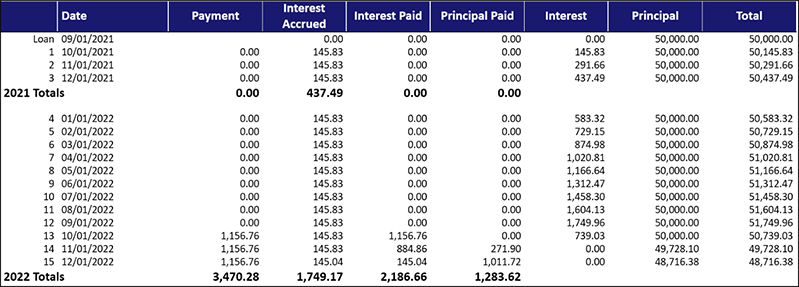

As of May 6 2022 SBA is no longer processing COVID-19 EIDL loan increase requests or requests for reconsideration of previously declined loan applications. Payments are deferred for 24 months during which interest will accrue from the date of first disbursemen t of the Applicants original COVID EIDL loan.

Economic Injury Disaster Loan Emergency Advance Eidl

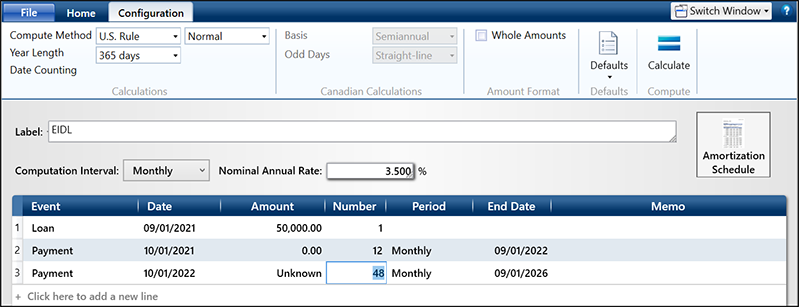

Enter the Loan Amount Enter the expected Number of Payments Enter the anticipated Annual Interest Rate Set Payment Amount to 0 the unknown.

. Small businesses small agricultural cooperatives and most private nonprofit organizations located in a declared disaster area and which have suffered substantial economic injury may. Posted May 30 2020 1946. Updated 4112022 for March 15.

When you look at an amortization calendar also called an amortization table youll see what your principal payment amount will be each month of your loan what your interest. It does not match up with any amortization. Damn okhonest question did no one answer my post because they dont give.

Learn how to monitor the status of your COVID EIDL make payments and request servicing actions. The SBA will provide you with the date that your loan payments will begin the monthly payments that will be due and the payoff date. The former includes an interest-only period of payment and the latter has a large principal payment at loan maturity.

This EIDL Amortization schedule provides the user a way to see how much interest is being paid with the payment deferrals 12 24 and 30 month tabs. As of May 16 2022 the. For loans with a maturity that exceeds 12 months the.

Las Vegas NV. I cannot figure out how the monthly loan payment stated in the note is calculated. As of September 8 2021 new COVID EIDL policy changes took effect as follows.

The loan term is 30 years. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. The 7 a fees for loans approved in FY 2022 between October 1 2021 through September 30 2022 are.

The EIDL is a 30-year loan with an interest rate of 375 275 for nonprofits meaning a loan to a business of 150000 will accrue over 5600 in interest over the year of deferment. It also determines out how much of your repayments will go towards. Click either Calc or.

Maximum loan cap increased from 500000 to 2 million Use of funds was expanded to include payment and. My Amortization Calculator will. Does anyone have an EIDL loan amortization schedule or a tool to build one.

The first payment in not due for one year from the funding date because of automatic deferment. However the interest appears to accrue from the loan date. An amortization schedule sometimes.

362 rows 30 Year Amortization Schedule is a loan calculator to calculate monthly payment for your fixed interest rate 30-year loan with a 30 year mortgage amortization schedule excel. You or your bookkeeper need to.

Should I Accept The Eidl Loan Eidl Calculator Youtube

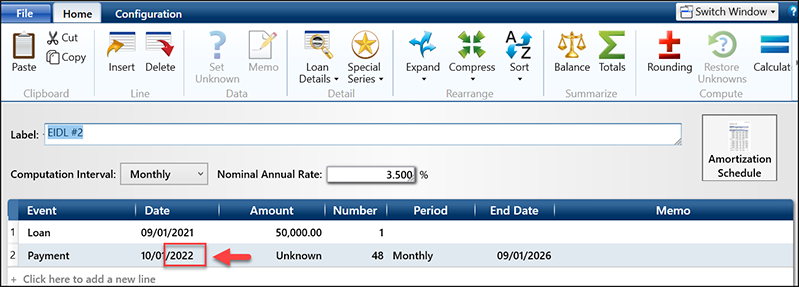

Economic Injury Disaster Loans Eidl Timevalue Software

How To Calculate Your Eidl Loan Amount Lantern By Sofi

Pdn40ynbmmn9cm

Big Eidl Loan Update April 2021 With Calculator And Tracker Youtube

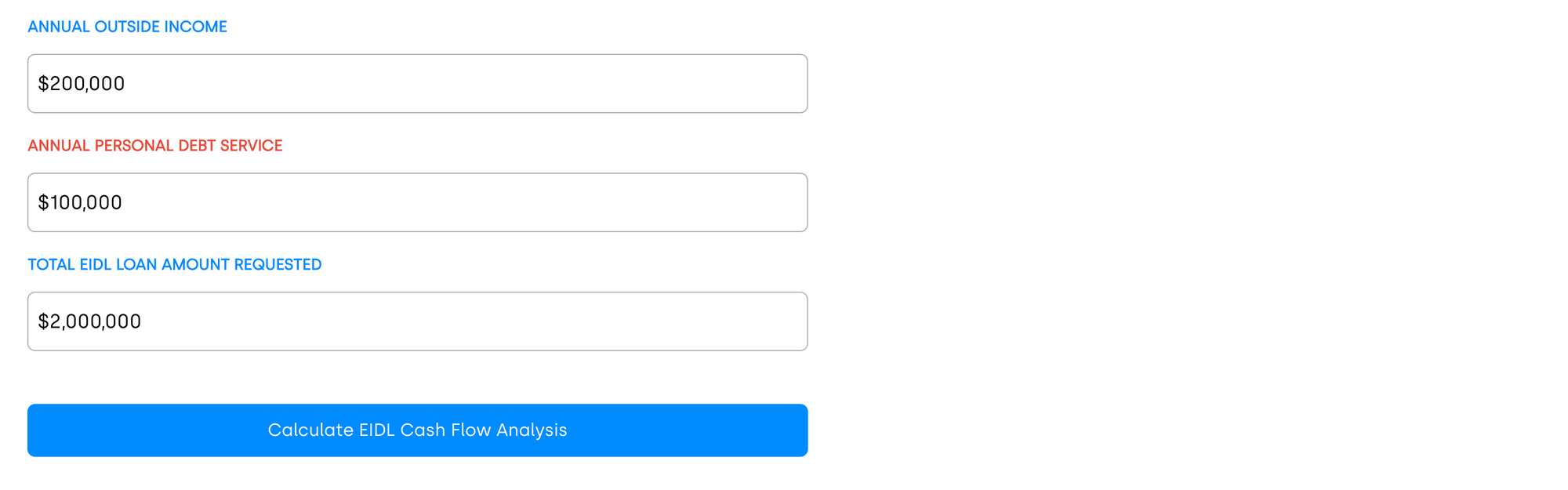

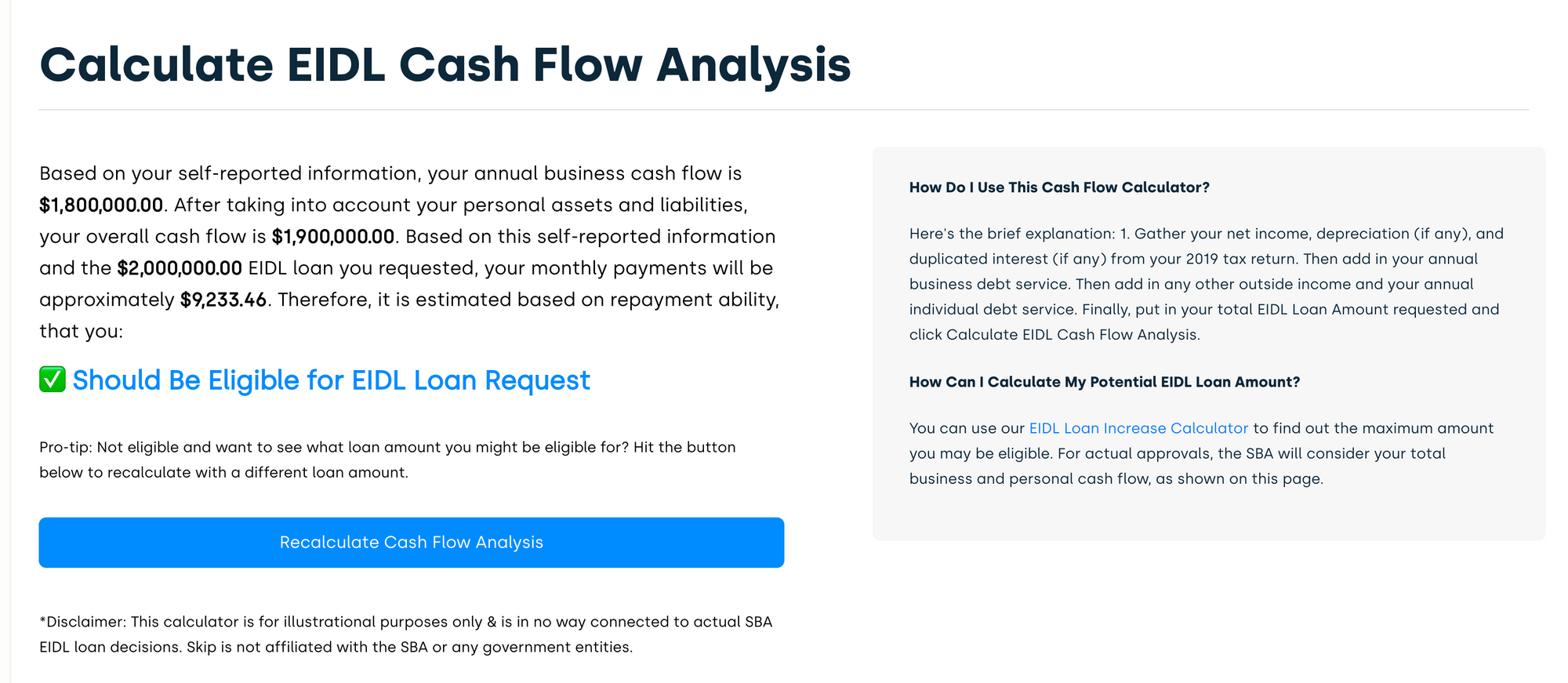

How To Check Eidl Approval With Cash Flow Calculator

Economic Injury Disaster Loans Eidl Timevalue Software

Ppp Loan Forgiveness Application Guide Updated Gusto

Mortgage Calculator Upwise Capital

How To Check Eidl Approval With Cash Flow Calculator

Breaking Here S How Sba Loan Officers Make Eidl Decisions

How To Check Eidl Approval With Cash Flow Calculator

Eidl Repayment Schedule How Much Interest Will You Pay Loan Amortization Free Download Youtube

Big Eidl Loan Update April 2021 With Calculator And Tracker Youtube

Economic Injury Disaster Loans Eidl Timevalue Software

Eidl Deadline Is In 2 Weeks Here S What You Need To Do Today

Sba Loan Modification Is Being Processed Concepts Builder